As the eCommerce industry continues to grow and evolve, it's crucial for brands to stay up-to-date on the latest trends and technologies in order to stay competitive. Fospha, with a market-leading independent attribution model and data from across European and North American eCommerce brands, are in a unique position to read the market and make data-driven predictions on the future of eCommerce advertising.

In this article, we'll explore Fospha's top six predictions for the year ahead and discuss how brands can leverage these trends to drive success in the eCommerce space.

Summary:

-

TikTok will continue to grow as an alternative ad channel, but costs will rise accordingly

-

Meta will remain the de facto ad platform of choice for driving eCommerce sales at scale

-

Increased scrutiny will be applied to high performing Performance Max accounts

-

Pinterest will cement its status as a top-of-the-funnel channel

-

High-performing brands will differentiate themselves by indexing to top of funnel ads

-

Google Analytics will be abandoned as the source of marketing truth

1. TikTok will continue to grow as an alternative ad channel, but costs will rise accordingly.

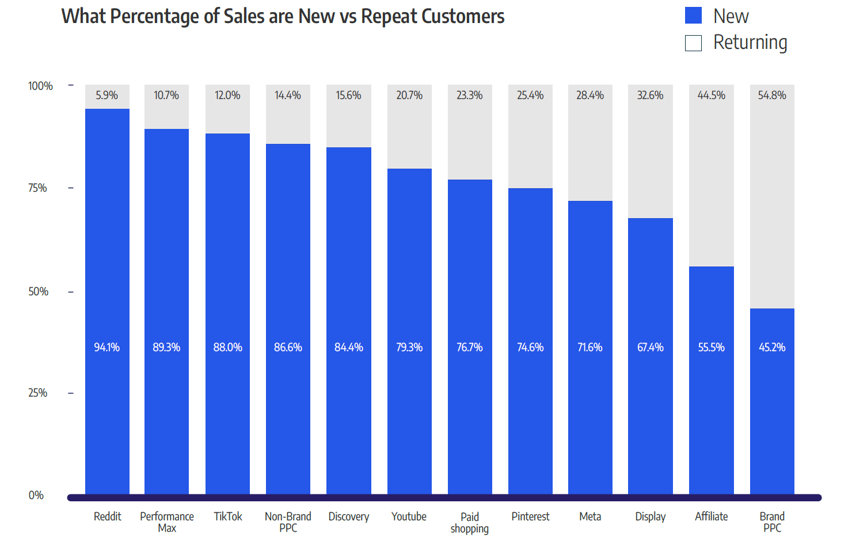

TikTok, the social media platform known for its short-form video content, has exploded in popularity in recent years and is expected to continue its growth as an alternative ad channel. Fospha data shows that investment in TikTok is growing faster than any other digital platform. The returns from the platform are also very strong, outperforming other growing properties like YouTube, and it is second only to Reddit for Paid Social platforms in delivering new customers.

Balance of new customers driven by different channels when measured using Fospha. Data from Fospha’s Q1 State of eCommerce Advertising Report.

This growing focus on TikTok ads is a trend that is not going to stop – brands looking to diversify beyond Meta and Google and boost their ROAS figures will continue to allocate more of their ad budgets to the platform.

In fact, we can see the increasing demand for various video editing tools in the market, and these tools even offer advanced features such as voice dubber, AI avatars generator, TikTok downloader and translator, background remover, and screen recorder.

However, as demand for ad space on TikTok increases, so too will costs for advertisers. In 2022 Fospha have advised that TikTok ads are a no brainer for almost every eCommerce brand spending over $50k/month on paid media. This year, with costs likely to rise, it will not be enough to simply get on the pitch and start spending – optimization strategy will become key to making the platform yield at high return.

One way for brands to maximize their ad spend on TikTok is by creating high-quality, engaging content that resonates with the platform's audience. Creative remains a key source of differentiation on the platform – TikTok’s Dave Morrisey gives some excellent advice on how to make this happen in this Q4 webinar co-hosted with Fospha.

2. Meta will remain the de facto ad platform of choice for driving eCommerce sales at scale.

Meta, the leading ad platform for eCommerce brands, is expected to remain the go-to choice for companies looking to scale their online sales in 2023. Meta's sophisticated targeting and optimization capabilities, and massive cross-generational reach, make it the top choice for eCommerce brands looking to reach and convert their ideal customers.

In 2022, we saw Meta spend fall 12% as advertisers looked to tighten their belts in worsening economic circumstances. The reasons for this are very clear – as a channel which relies on delivering value through impressions, Meta’s self-reported results have seriously struggled since the introduction of Apple’s iOS 14.5 update in 2021. This is true for almost all impressions-based channels, which now underreport their sales in their analytics platforms (see point 6 below), but as the most high-profile example Meta has suffered the biggest knock in consumer confidence.

Although confidence in Meta is at a 5 year low, Fospha data clearly demonstrates that the ROAS Meta drives is very high considering its scale. As brands move towards advertising at the top of the funnel, and Meta continue to release new ad formats and upgrade their product, quality will shine through and we expect to see the platform continue to be the platform of choice for eCommerce advertising at scale.

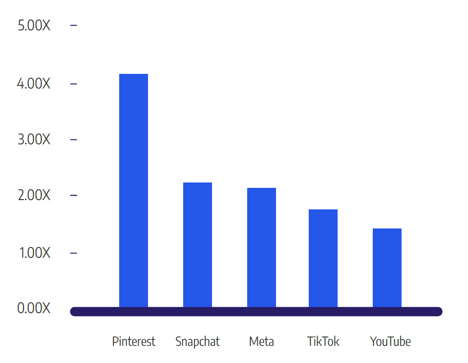

ROAS by Paid Social platform measured using Fospha showing that Meta delivers a massive ROAS considering its scale. Data from Fospha’s Q4 State of eCommerce Advertising Report.

3. Increased scrutiny will be applied to high performing Performance Max accounts.

While 2022 was a strong first year for Google’s Performance Max property, we expect to see increased scrutiny into the role it actually plays in driving customers. While early reported results have been very positive, Fospha research shows that much of this is good optics rather than increased performance. By blending the reporting of Brand and Generic PPC, a common rookie error that gives very inflated ROAS figures, Google are presenting a generous picture here. Other tactics, such as moving the high-performing Smart Shopping format from Paid Shopping into Performance Max, is another optical change that will make little difference to the overall revenue delivered by most brands buying these ads. This adjustment has also heavily cannibalized Paid Shopping – Fospha data shows it moved from the highest-performing large marketing channel at the start of the year to one of the lowest by Q4.

The development of automated delivery formats such as Performance Max and Meta’s Advantage+ is a major emerging trend as ad platforms seek to boost performance following a wave of privacy-related challenges. While these have been feted by some, they have also met stiff resistance – partly from agencies, who see them as a threat to their revenues, and partly from marketers who are understandably reluctant to adopt yet another black box function.

The measurement of these emerging formats will be key for attribution platforms and brand-side marketers alike in 2023.

4. Pinterest will cement its status as a top-of-the-funnel channel.

We expect Pinterest, the visual discovery platform, to solidify its status as a top-of-the-funnel ad channel in 2023. While traditionally popular with home furnishings brands, Fospha is seeing Pinterest attract – and excel for – brands from other verticals as well. Fospha data shows Pinterest plays a higher-funnel role than Meta – brands should consider diversifying into the platform to drive initial awareness and interest in their products and services. Pinterest’s user base is highly engaged and actively seeking out new products and ideas, making it a valuable asset for brands looking to get their products in front of potential customers, and crucially it is consistently the best performing channel for ROAS when measured by Fospha. 2023 could be the year it follows TikTok into achieving the early stages of mass adoption.

Relative ROAS of different Paid Social platforms when measured using Fospha. Data from Fospha’s Q4 State of eCommerce Advertising Report

5. High-performing brands will differentiate themselves by indexing to top of funnel ads.

2023 promises a tougher market than most D2C brands have ever faced – tougher even than 2022, which saw high-profile losses, particularly in the UK market which has been affected by the triple-whammy of Brexit, supply chain issues from the war in Ukraine and the ongoing impact of COVID-19. In these times it is tempting to batten down the hatches and reduce marketing budgets, which is the pattern we saw beginning to play out throughout 2022.

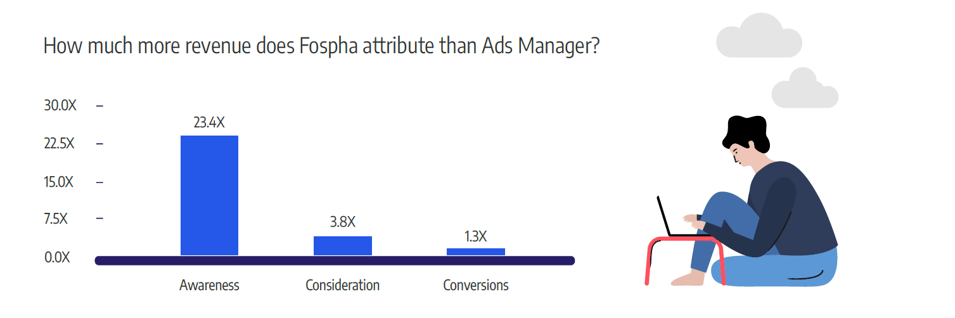

This has a knock-on impact on marketing mixes, too. When measuring using Google Analytics or Meta Ads Manager, both very bottom of funnel-focused platforms, it is tempting to strip budget away from hard-to-measure Brand and Awareness campaigns and redistribute it towards channels where the relationship to revenue is much easier to demonstrate. Fospha data shows that this is an error. Brands spending across the full marketing funnel, with as much of a focus on demand generation as capture, consistently have the healthiest marketing mixes. While focusing on just bottom of funnel ads may seem like an easier and safer decision, it is a short-term play and the best-performing brands will differentiate themselves by bravely investing across the full funnel.

The early signs indicate that this will play out – it can be no coincidence that the most common reason given for signing up to Fospha’s free trial in Q4 2022 was to properly measure top of funnel ads.

Difference between Fospha measurement and Meta Ads Manager reporting throughout the funnel. Data from Fospha’s Q1 State of eCommerce Advertising Report

6. Google Analytics will be abandoned as the source of marketing truth.

Our last prediction is one that may concern businesses using GA as a source of truth. With Universal Analytics set to stop tracking in July 2023, brands are busy setting up GA4. Significant challenges await this summer – as well as onboarding a new and complex system, marketers using GA as a source of truth will also have to contend with the loss of year-on-year data in the platform, as there is no option to integrate UA data into GA4.

Although frustrating, this is a blessing in disguise. As above, the most successful brands in 2023 will be those advertising at the top of the funnel, and in channels like TikTok which GA struggles to measure. Systems like Fospha can integrate data from GA3 and GA4 to provide a consistent view – and remodel it to incorporate the role of upper funnel ads and impressions. Adopting solutions like this tiktok analytics will open doors that GA has been keeping firmly shut.

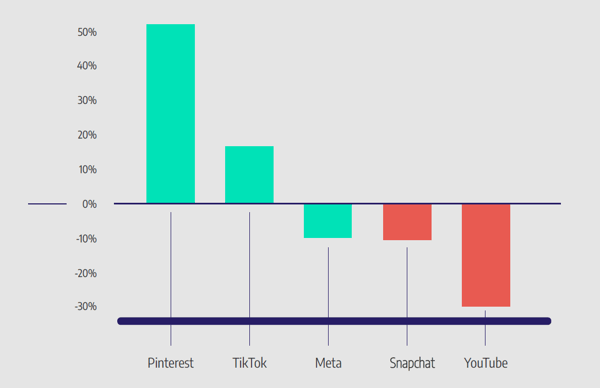

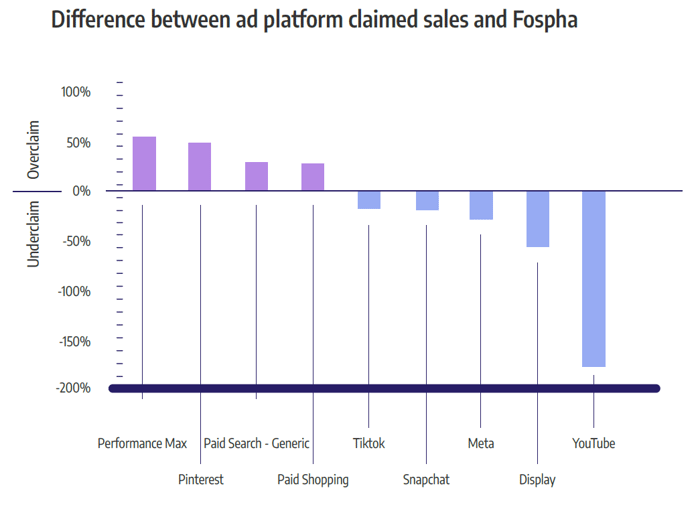

We expect brands to continue to move away from in-platform measurement on platforms like TikTok and Meta too. It has been almost 2 years since Apple’s iOS 14.5 update, and there are still only limited signs of a recovery of ad platform measurement. It is very telling that when audited against Fospha’s own measurement, almost every channel that relies on delivering impressions to generate revenue is underreporting its performance, whereas all the click-based channels are overclaiming. Alongside the challenge of consistently generating high-quality creative, measurement is a challenge that just will not go away.

Difference between Fospha measurement and platform-reported sales by channel. Data from Fospha’s Q4 State of eCommerce Advertising Report

For brands, the impact is massive. Impressions-led media and top of funnel advertising are key to reaching new audiences - not to mention maintaining competitive advantage in a worsening market. Spending blind is unlikely to keep being an option, and more and more brands will turn to independent measurement, such as a TikTok analytics tool, to validate their cross channel spend.