Snap Selects Fospha as Measurement Partner for Retail eCommerce

Snap and Fospha partner to boost eCommerce ad effectiveness on Snapchat, enabling precise campaign measurement and improved ROI.

This piece has been written in collaboration with Grow.co

Measuring media performance has long been a challenge for marketers – and it’s only been exacerbated by cookie deprecation. This is particularly true for impressions-led channels, where losing visibility over the customer journey has made it feel impossible to prove the effectiveness of such channels (Paid Social, Display). While performance in platforms like Google Analytics or platform Ads Managers can make for grim reading for channels like Snapchat, measurement provider Fospha has released data telling a different story. Grow.co & Fospha were interested in exploring this further.

In Q1’s State of eCommerce Report, Fospha revealed that ad platform misattribution is even more pronounced with channels that make up a smaller proportion of brands’ channel mixes – including Snapchat.

.png?width=550&height=323&name=G1-%20(1).png) Unlike how Google Analytics or ad platforms attribute, Fospha uses machine learning to assess the impact of impressions on conversions. Their method is resistant to cookie depreciation, modelling based on aggregate impressions, rather than individual customer journeys. Snapchat is an impressions-driven channel, a powerful tool for promoting brand exposure rather than encouraging immediate action. This means that click-based methods struggle to capture its true impact.

Unlike how Google Analytics or ad platforms attribute, Fospha uses machine learning to assess the impact of impressions on conversions. Their method is resistant to cookie depreciation, modelling based on aggregate impressions, rather than individual customer journeys. Snapchat is an impressions-driven channel, a powerful tool for promoting brand exposure rather than encouraging immediate action. This means that click-based methods struggle to capture its true impact.

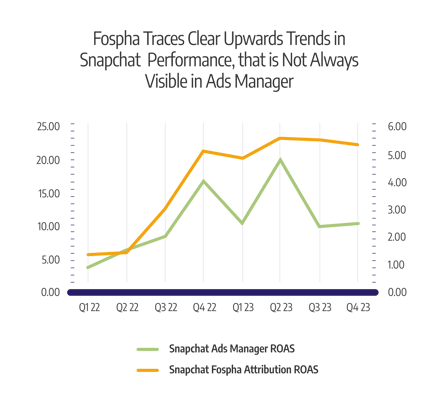

With insight across top brands in the US, UK, and Europe, Fospha uncovered that Snapchat has seen strong performance across 2022 & 2023, with ROAS skyrocketing from 1.38 to 5.37 YoY. This is a rare feat in the context of Snapchat spend rising by 76% - a promising sign that this channel functions more efficiently at higher levels of spend.

When looking at how Fospha has measured this ROAS growth over time, we see a clear and consistent upwards trend, gradually building as brands start to spend more throughout 2023. As with many channel-owned ‘Ads Manager’ reporting tools, privacy restrictions in the last few years have made measurement unpredictable. Consequently, we can see Snapchat misattributing its own performance. From an average ROAS low of 3.67 to a high of 20.24, performance appears highly variable between advertisers, making it difficult to make conclusions on channel effectiveness.*

Despite persisting challenges with attribution, Snap is making strides to improve their performance marketing product in 2024, particularly following recent difficulties. On 6th February, Snap posted their Q4 ’23 earnings, reporting revenue that fell below expectations. However, they’ve since identified leaning into their revamped performance marketing product as a key area of focus this year. Fospha data aligns with this, showing Snap ROAS rising since their release of a new 7/0 attribution and optimization model in Ads Manager. As a result, Fospha data indicates that Snap will continue to trend positively across the next 12 months.

Despite persisting challenges with attribution, Snap is making strides to improve their performance marketing product in 2024, particularly following recent difficulties. On 6th February, Snap posted their Q4 ’23 earnings, reporting revenue that fell below expectations. However, they’ve since identified leaning into their revamped performance marketing product as a key area of focus this year. Fospha data aligns with this, showing Snap ROAS rising since their release of a new 7/0 attribution and optimization model in Ads Manager. As a result, Fospha data indicates that Snap will continue to trend positively across the next 12 months.

As brands start to scale Snapchat, it’s crucial to consider optimizing across the entire funnel. Snap claim full funnel investment to be a vital long-term strategy, as it improves performance further down the line. Their general recommendation is to start with Snap Ads and Story Ads – these are the strongest performers, with the former performing best from a CPM point of view.

Fospha’s research supports this, finding that KPIs improve significantly for brands who maintain spend in higher funnel objectives (i.e. Traffic & Brand Awareness) for 3-10+ months. While an initial drop in performance is expected as brands shift away from a sole focus on Conversion, after 10 months, diversified brands saw a +42% higher ROAS than their counterparts, and 11% lower CPP on average.

As marketing budgets have increasingly come under pressure to deliver higher ROI in the years since COVID-19, a diversified channel mix is essential. It’s encouraging to see that measurement that can support this, helping marketers make a business case for investing in Paid Social.

*The Snapchat Ads Manager attribution window is client-dependent, comprising 28/1 or 7/0 on a case-by-case basis.

Snap and Fospha partner to boost eCommerce ad effectiveness on Snapchat, enabling precise campaign measurement and improved ROI.

Read how the launch of iOS 14 shook the Advertising world for data measurement.

Fuelled by a powerful attribution model and data from across the eCommerce space, Fospha offer their data-driven marketing predictions for 2023.